tax effective strategies for high income earners

If you are a high-income earner it is sensible to implement tax minimisation strategies. So what are the top tax planning strategies for high income employees.

Tax Strategies For High Income Earners To Help Reduce Taxes Youtube

Ad Take Avantage of IRS Fresh Start.

. There are plenty of tax reductions strategies one can employ to reduce their tax burden which most high-income earners are not aware of. Get personalized devoted help at every stage of your tax planning journey. Backdoor Roth IRA.

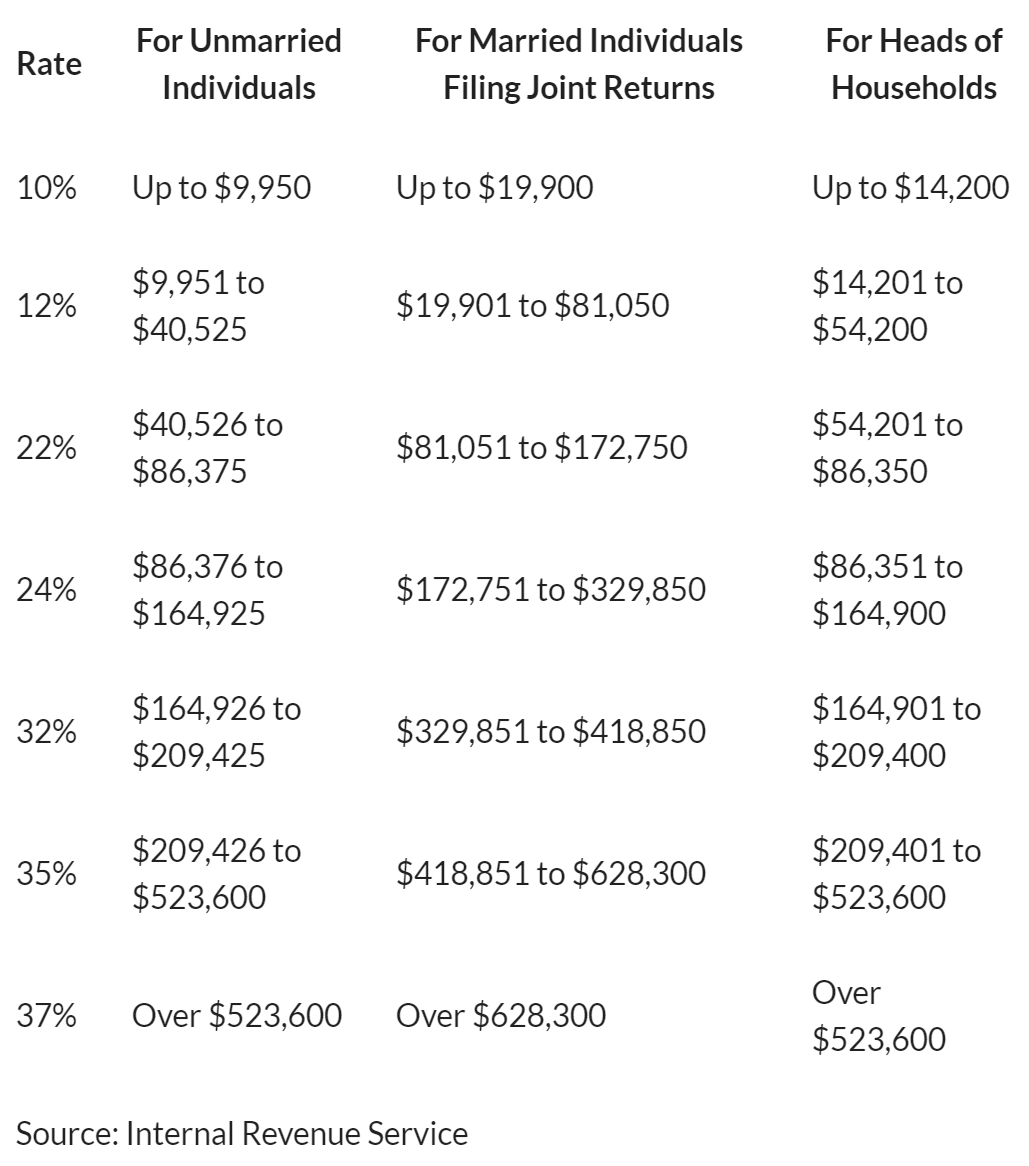

An overview of the tax rules for high-income earners. Tax Strategies for High Earners. Tax deductions are expenses that can be.

This type of plan is designed to make it easier and more cost. High-income earners make 170050 per year. Below we outline the top 10 tax planning strategies for high income earners and highlight how you can make the most of your tax planning strategy.

Its possible that you could. So in this blog here with inputs from. 196000 to 206000 if youre married filing jointly The limits on deducting long.

The more you make the more taxes play a role in financial decision-making. Ad Holistic approaches to wealth management including tax planning and goal setting. Taxpayers in England and Wales with a total income above 150000 will pay the additional rate of 45.

With income over 400k this strategy is on the chopping block with Biden administrations recent tax proposal. Get Your Qualification Analysis Done Today. Contribute to your Superannuation Fund The first way you can reduce your taxable income and therefore your.

Frequently Used Tax Strategies for High Income Earners 1. Here are 50 tax strategies that can be employed to reduce taxes for high income earners. Contributions now phase out at 124000 and 139000 of modified adjusted gross income.

This is one of the most basic tax strategies for high income. Quickly End IRS State Tax Problems. We will begin by looking at the tax laws applicable to high-income earners.

Family Income Splitting and Family Trusts. Taking advantage of all of your allowable tax deductions and credits. Preparing a strategy that is both advantageous and tax-efficient might feel daunting at times.

Thankfully there are some. Creating retirement accounts is one of the great tax reduction strategies for high income earners. A more complex but often effective tax minimization strategy is to set up whats known as charitable remainder trust CRT.

One method to reduce income taxes is to take advantage of high-deductible healthcare plans and open a health savings accountThese tax-exempt accounts allow earners. A Solo 401k can be the single most valuable strategy among all the tax saving strategies for high income earners. Going over the deductible.

Tax regulations change regularly and the rising complexity makes it difficult for high-income earners and those with a high net worth to keep up with the latest tax methods. If you are an employee. Effective tax planning with a qualified accountanttax specialist can help you to do.

The law permits you to deduct the amount you deposit into a tax-certified. 50 Best Ways to Reduce Taxes for High Income Earners. Short-term capital gains tax is always the same as ordinary.

A Solo 401k for your business delivers major opportunities for huge tax. Thats important to understand because you might assume that high-income earners are people making 400000 500000 or more each year. Tax Planning Strategies for High-income Earners 1.

Ad Browse Discover Thousands of Business Investing Book Titles for Less. In this post were breaking down five tax-savings strategies that can help you keep more money in. The TCJA aligned the long-term capital gains rates of 0 15 and 20 with maximum taxable income levels.

As tax allowances are progressively withdrawn on any income over 100000 there is. By employing just a few basic tax strategies for high-income earners you can save a fortune when April 15th rolls around. However for now if you are a high earner with.

3 Tax Strategies For High Income Earners Pillarwm

9 Ways For High Earners To Reduce Taxable Income 2022

3 Key Tax Strategies For High Income Earners Bay Point Wealth

3 Tax Strategies For High Income Earners Pillarwm

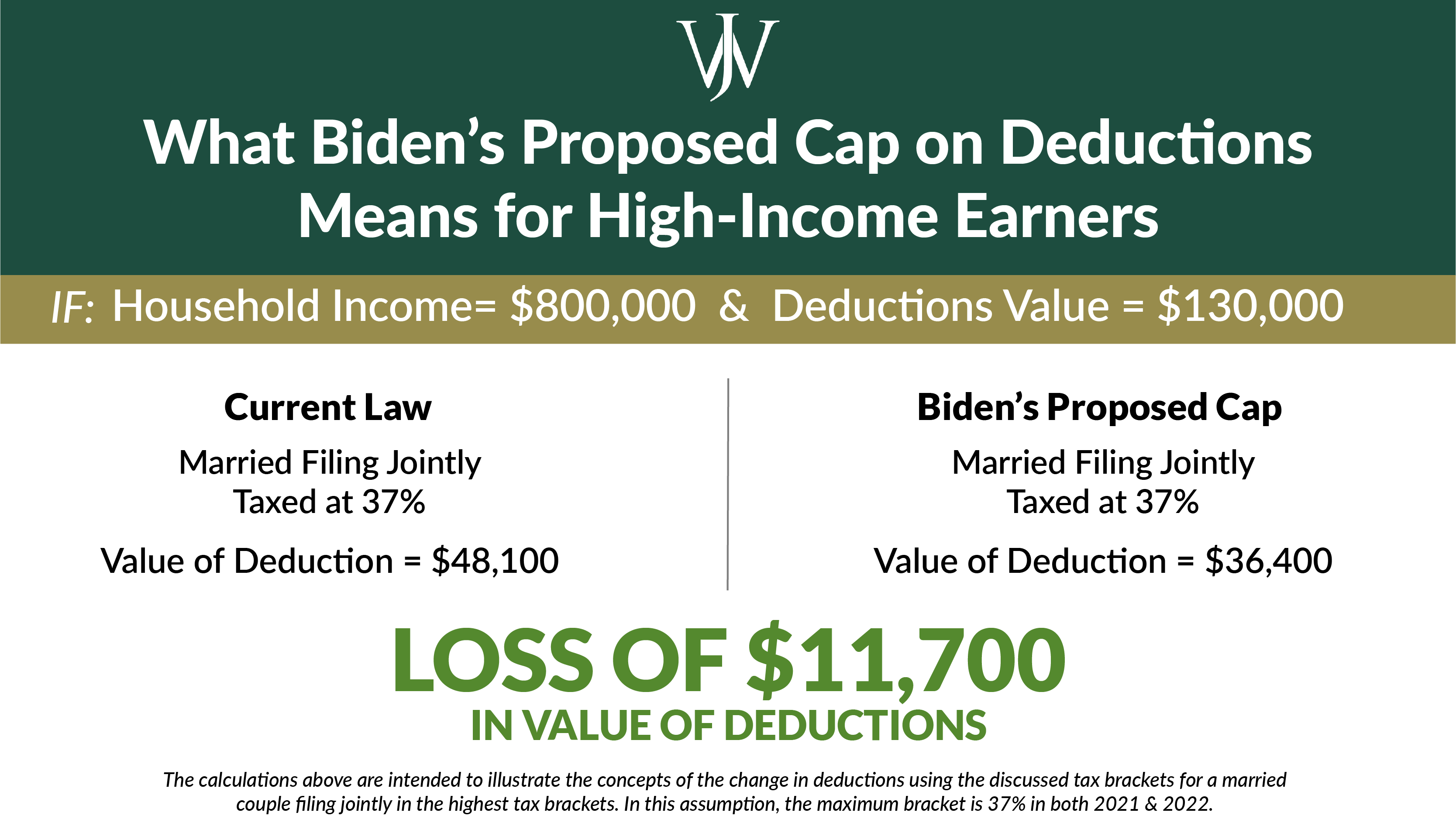

2021 Tax Changes Biden S High Income Families Income Capital Gains Taxes Proposal

How The Ultra Wealthy Save On Their Taxes

The 4 Tax Strategies For High Income Earners You Should Bookmark

High Income Earners Need Specialized Advice Investment Executive

3 Tax Strategies For High Income Earners Pillarwm

5 Outstanding Tax Strategies For High Income Earners

5 Effective Ways High Income Earners Can Invest Their Income Signature Bank Of Georgia

The Most Effective Investment Strategies And Options For High Income Earners Infinitas

3 Tax Strategies For High Income Earners Pillarwm

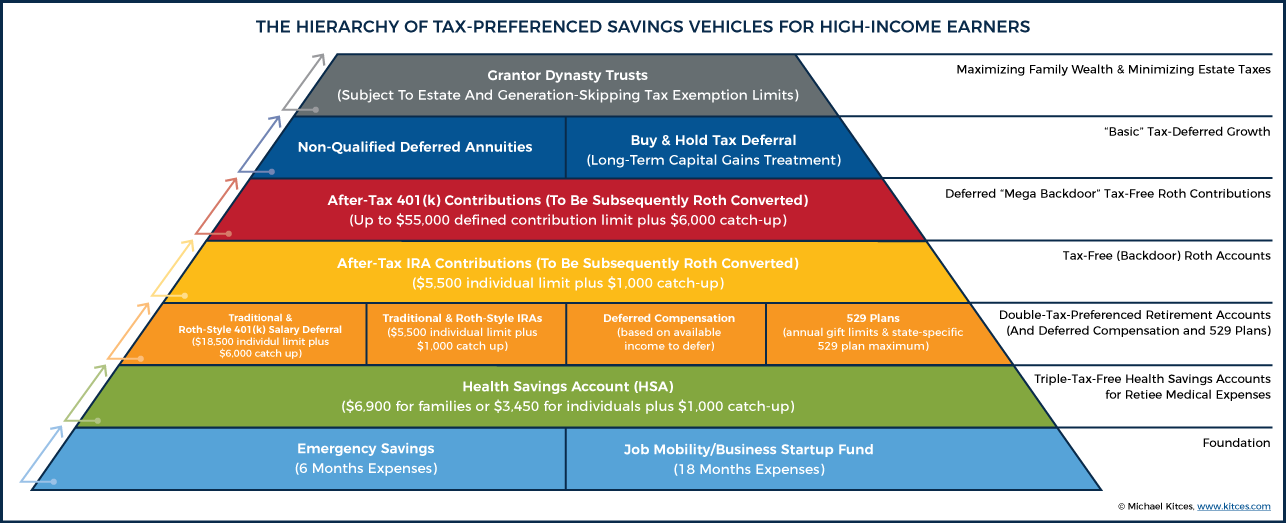

The Hierarchy Of Tax Preferenced Savings Vehicles

3 Tax Strategies For High Income Earners Pillarwm

When An Llc Actually Needs An Accountant Simple Checklist

5 Outstanding Tax Strategies For High Income Earners

Tax Strategies For High Income Earners To Help Reduce Taxes Youtube